Apple and other tech giants – Amazon, Alphabet (Google) and Meta (Facebook) – have drawn antitrust concerns with their latest moves in financial services. The US Consumer Financial Protection Bureau (CFPB) is looking into Apple’s stock, its UK counterpart, the Financial Conduct Authority (FCA), has a broader view.

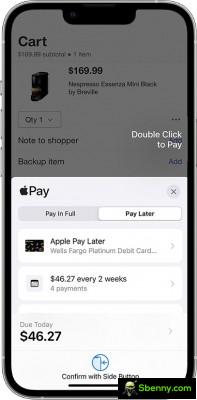

Some of Apple’s financial services like Apple Card are actually run by existing banks like Goldman Sachs. However, Apple acts as a stand-alone bank for the new “Pay Later” feature and that’s what caught the CFPB’s attention.

Apple introduced Pay Later with iOS 16

Apple Card is only available in the US right now, but there are signs it could be launched in the UK as well. For example, Apple recently acquired Credit Kudos, a British startup that carries out credit rating checks.

Other tech giants are also launching new financial services. For example, Amazon launched an online insurance store in the UK last week. FCA’s concern is that short-term consumer benefits can be leveraged by companies to crush market competition in the long term.

Here’s what the FCA said in a post yesterday:

“By combining financial services with their existing businesses, Big Tech companies can benefit consumers. These could be innovative new offerings with highly competitive pricing driven by greater efficiency, offering healthy competition with historical financial service providers.

But in the long run, Big Tech companies could pose competition risks if they quickly gain market share and are able to leverage market power. “

The FCA is not taking any action right now, it just wants to open a discussion with tech companies, consumers and even other regulators and talk about a “pro-competitive approach to digital markets”.

Start a new Thread